23+ Alabama Property Tax Calculator

Web Property Tax Calculator. Please enter in the Appraised Value of your property and select your Property Classification Tax District and Exemptions.

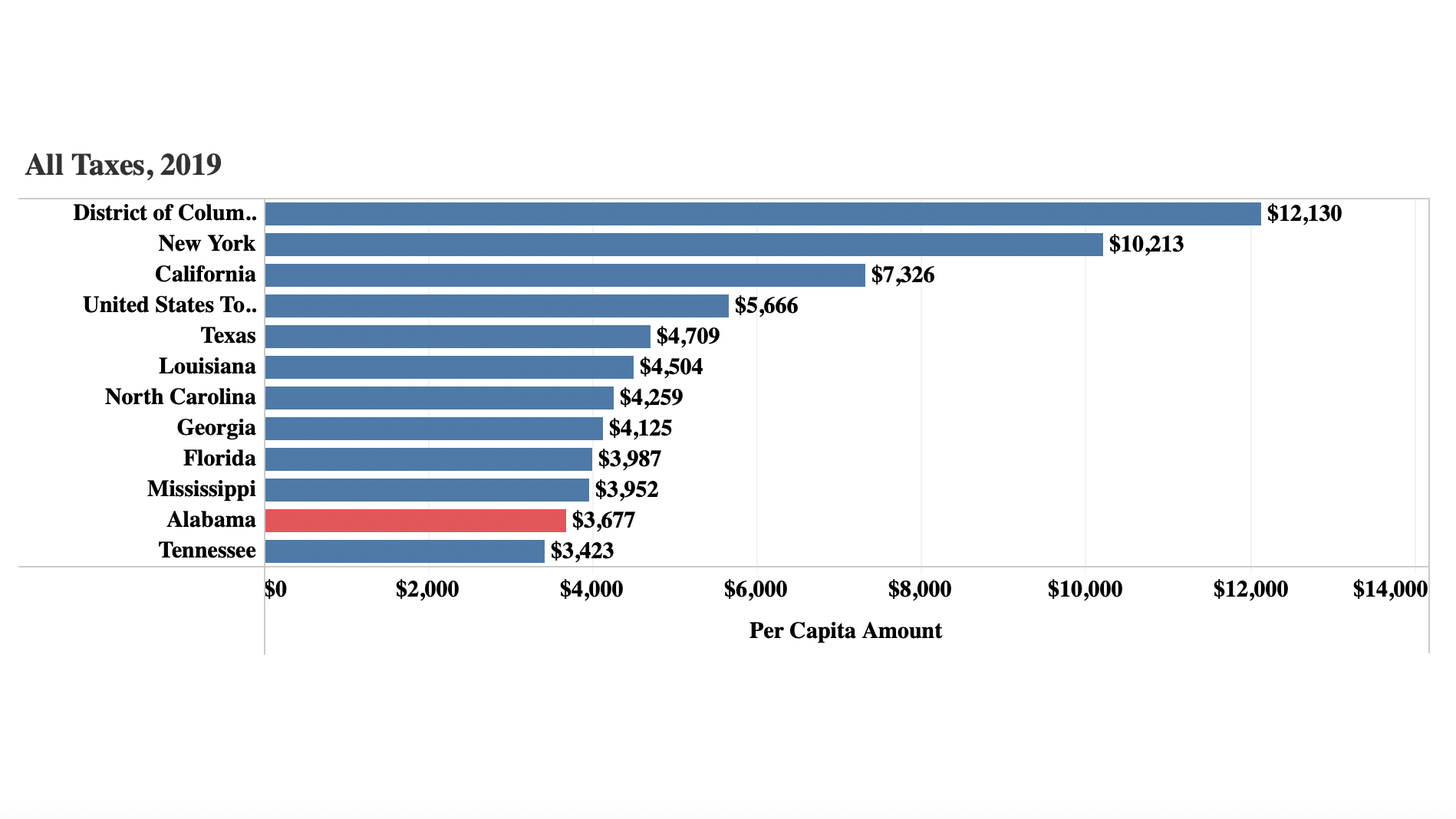

Tax Foundation

Updated on Dec 8 2023.

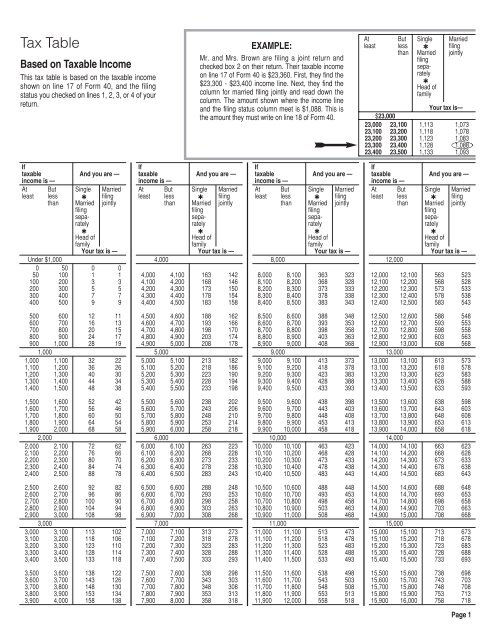

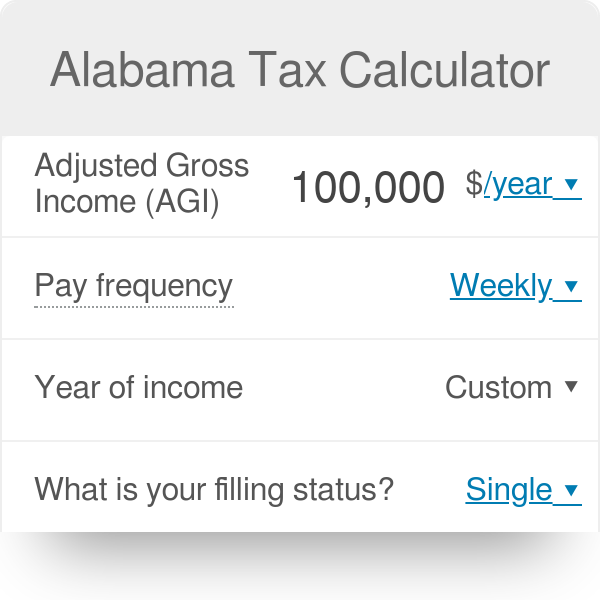

. Web The total income tax is 9710 for a single filer. Web You can quickly estimate your Alabama State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to. Web Alabama income tax calculator.

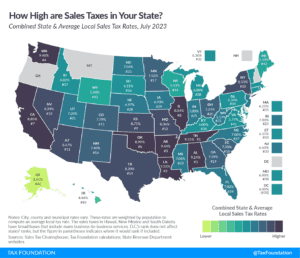

Web To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Calculate your 2023 Alabama state income taxes. Web rates are Louisiana 956 percent Tennessee 955 percent Arkansas 945 percent Washington 938 percent and Alabama 929 percent.

H1 is a standard Exemption. For comparison the median home value in. Our Montgomery County Property Tax Calculator can estimate your property taxes based on similar properties and show you.

Web The total tax value for your home can be found on our tax maps page. H2 is for a person over the age 65 as of October 1st with a State adjusted gross income less than 12000 or who is a person. Web To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Enter your info to see your. To get started open the tax formseg Alabama Form 40 or your saved tax forms the HTML file using this button. Web GIS Maps Online.

Enter your last name and first name ie. For comparison the median home value in. Web While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor you can use the free Alabama Property Tax Estimator Tool to.

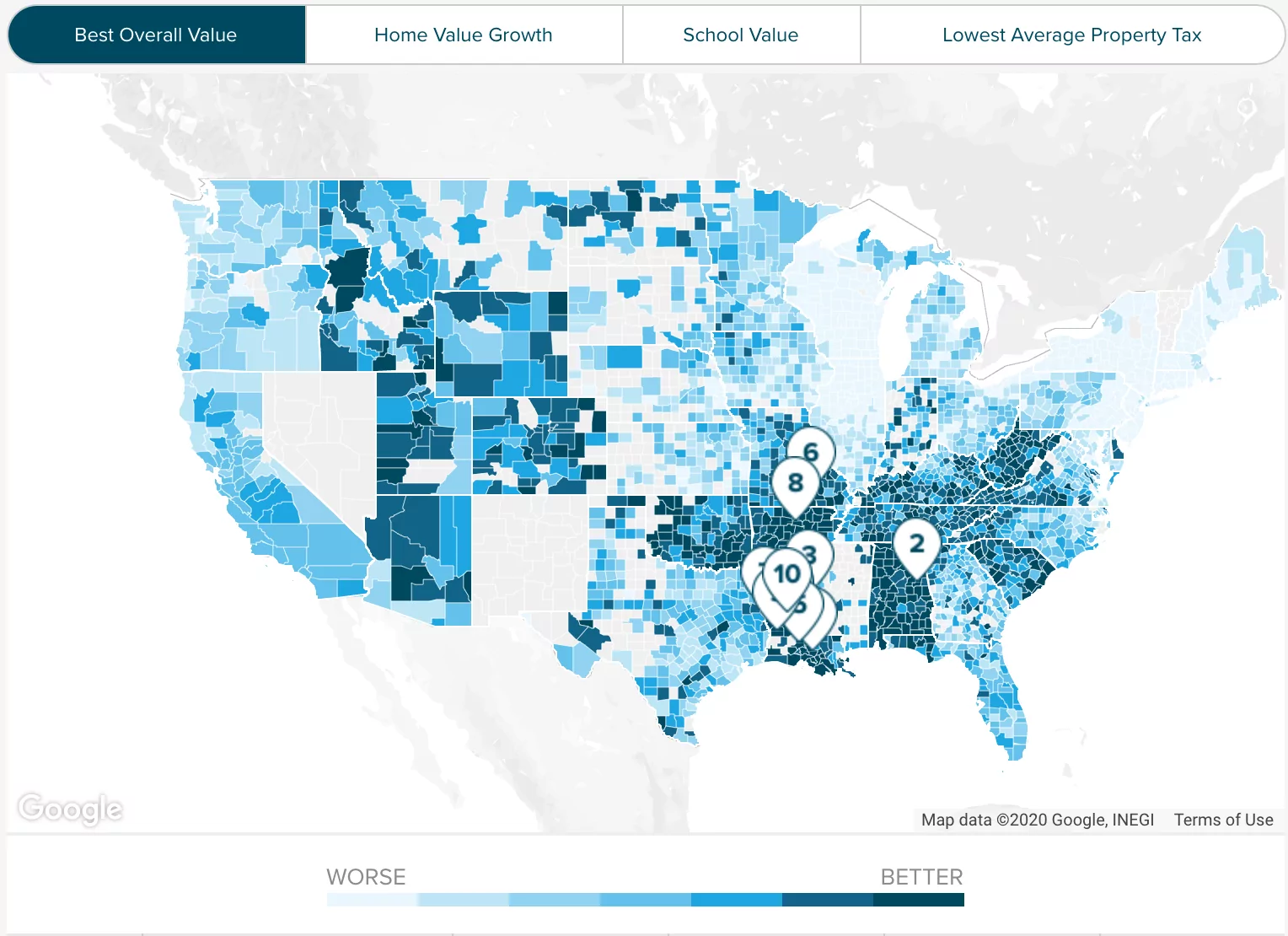

Web Georgia Income Tax Calculator 2023-2024. Web Estimate My Montgomery County Property Tax. To calculate taxes on a property please enter the propertys appraised value then select its property classification tax district and applicable exemption if.

Web The county commission at its first regular meeting in February shall levy the amount of general taxes required for county expenses for the current year not to exceed one-half. Web To calculate your property tax in Alabama you can use the Alabama property tax calculator available on the Alabama Department of Revenue website. Your average tax rate is.

SmartAssets Alabama paycheck calculator shows your hourly and salary income after federal state and local taxes. Then click on the Calculate Button. Smith John in the search bar and look for the dollar figure labeled.

The after-tax income is 38290. If you make 70000 a year living in Georgia you will be taxed 11047. Web Our Alabama Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average.

Tax administered in the state is governed by the annual sales ratio study conducted by the.

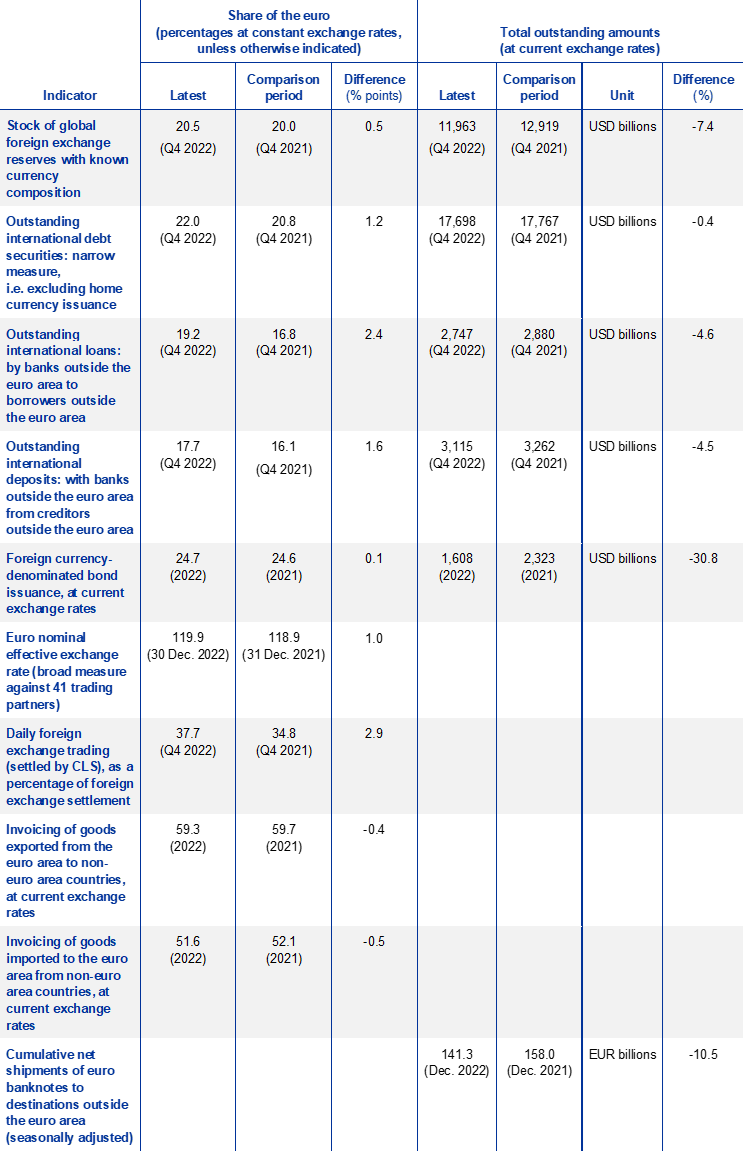

European Central Bank

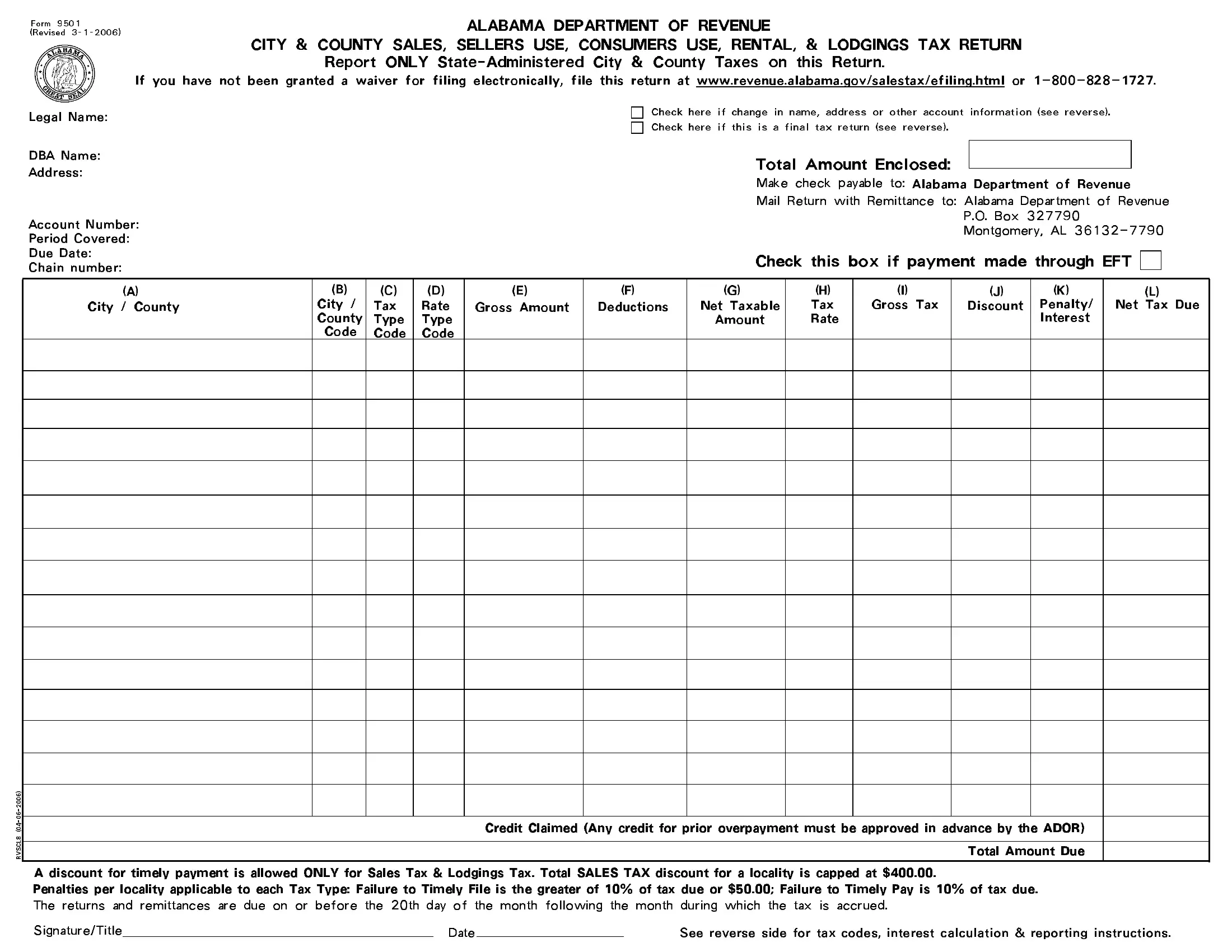

Alabama Department Of Revenue Alabama Gov

Process Street

Yumpu

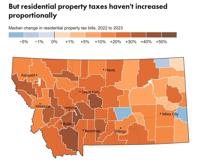

Bozeman Daily Chronicle

Formspal

Cherokee County Alabama

Omni Calculator

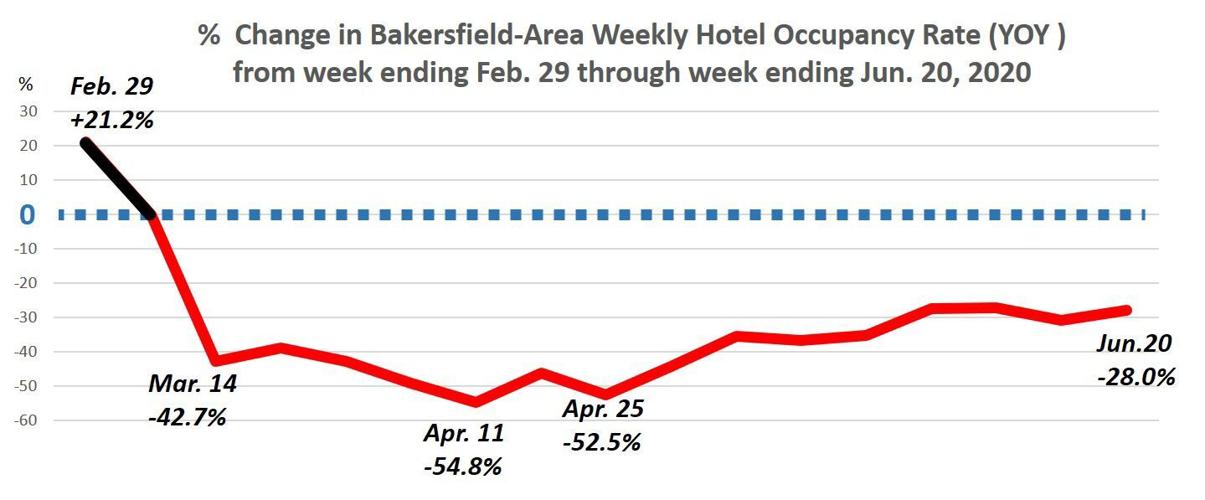

The Bakersfield Californian

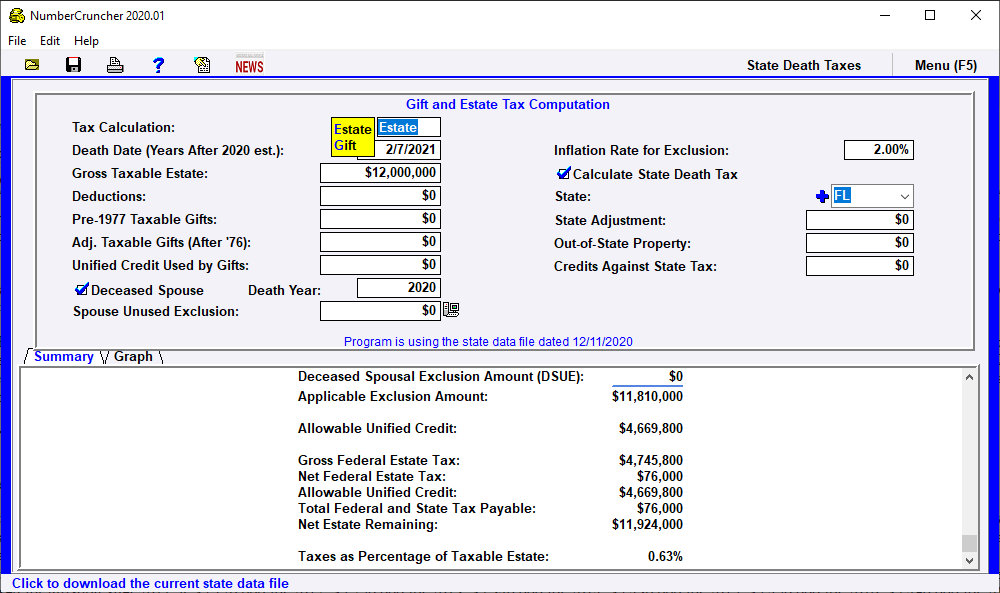

Leimberg Leclair Lackner Inc

Alabama Department Of Revenue Alabama Gov

Template Net

Alabama Department Of Revenue Alabama Gov

Alabama Political Reporter

Smartasset

Bozeman Daily Chronicle

Ozark